Make big purchases more manageable.

Ezra’s instalment loan solution lets your customers spread the cost of essential purchases over time. It is transparent, flexible, and fully integrated into their wallet experience.

Why Ezra

Flexible repayment options

Customers can select a repayment plan that works for them (1 to 6 months), making it easier to manage finances without disrupting daily cash flow. Whether it’s a one-time purchase or an urgent need, flexibility supports better budgeting and confidence.

Transparent pricing

All loan terms and fees are clearly presented upfront, so customers know exactly what they are committing to before they accept.

Higher loan amounts

Ideal for devices, school fees, home appliances, or working capital, giving customers the power to do more.

Income-aligned repayment

Repayments are automatically deducted from wallet inflows, ensuring a seamless and predictable experience.

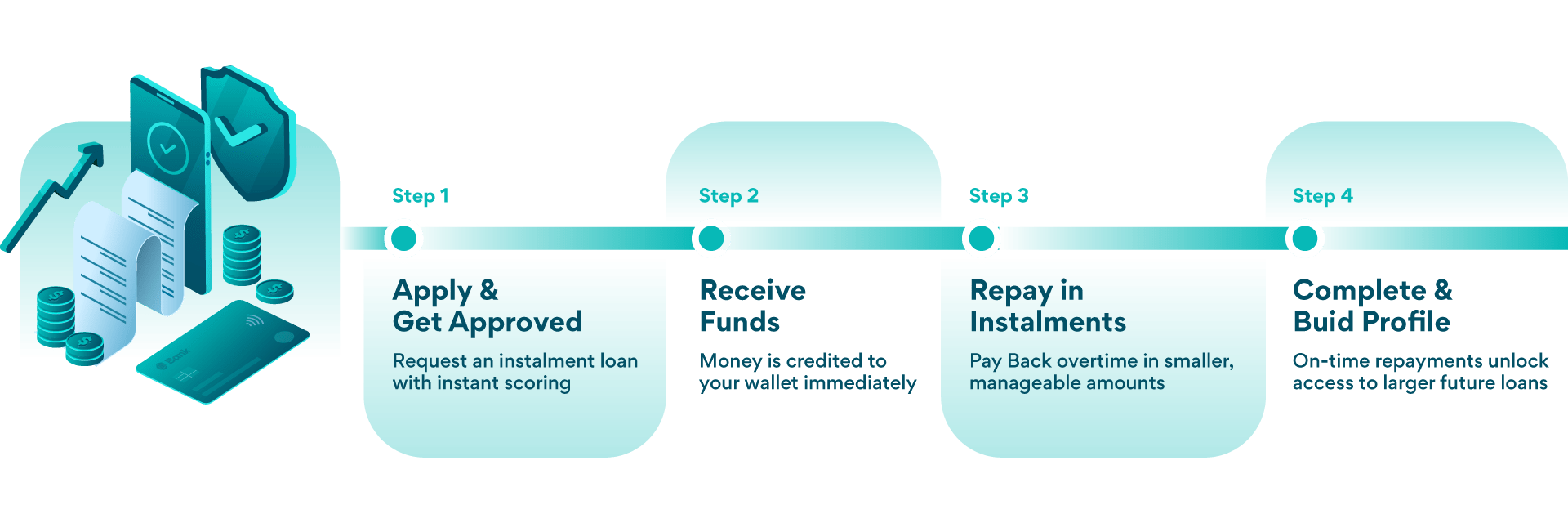

How it works

Flexible credit for what matters most

From smartphones and school fees to shop inventory and agent float, Instalment Loans help customers cover larger expenses and repay on terms that match how they earn. A parent can pay school fees upfront and spread repayments over their monthly salary inflows. A micro-merchant can stock up on bulk goods and repay gradually as sales come in. Even wallet agents can use the extra liquidity to manage higher customer demand, without cash flow stress.