Flexible payments embedded into every purchase.

Ezra’s BNPL solution lets your customers shop now and spread payments over time — automatically, through their mobile wallet. No credit checks, no extra apps. Just a seamless, built-in way to make bigger purchases more manageable.

Why Ezra

Instant approval at checkout

Customers receive a decision in real time, enabling them to complete their purchase immediately, without leaving the checkout flow.

No paperwork, no friction

No form or documentation required. Credit is accessed instantly, making the process fast, simple, and user-friendly.

Built for mobile money wallets

The solution works natively within mobile wallets, making it easy to activate, manage, and repay — all in one place.

Flexible plans, tailored to cash flow

Customers choose a repayment schedule that fits their income patterns, improving affordability and reducing default risk.

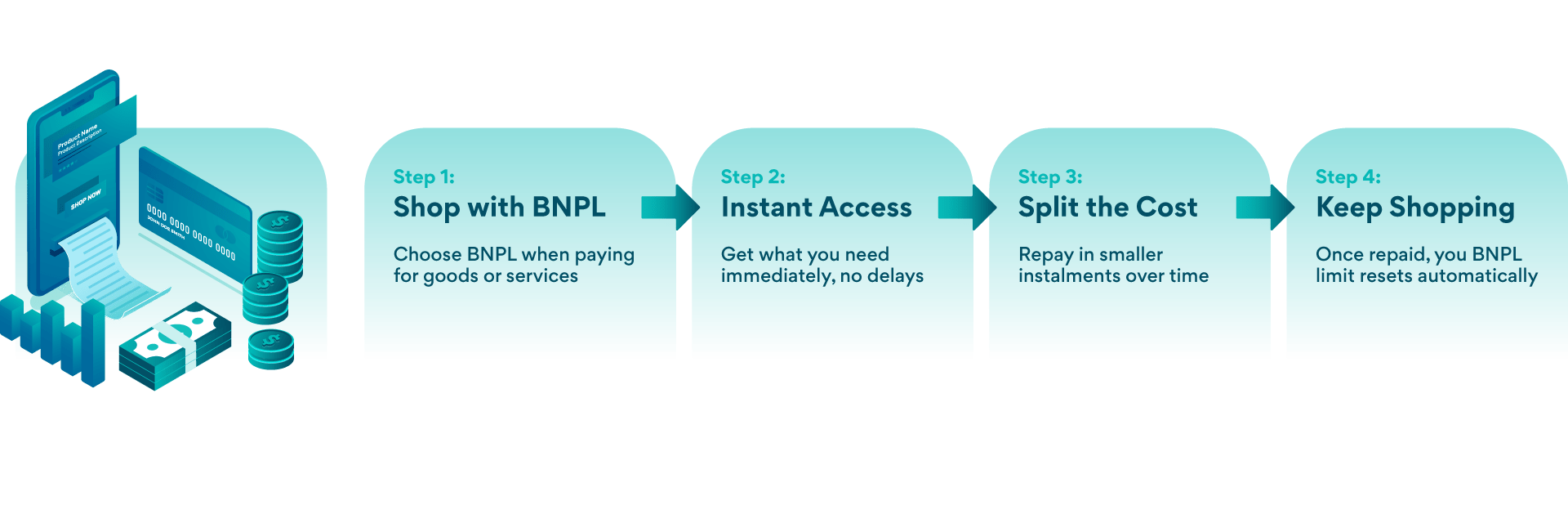

How it works

Built for everyday purchases

From fashion and appliances to phones and school supplies, Ezra’s BNPL empowers consumers to buy what they need, when they need it. It’s also a lifeline for small businesses covering upfront costs without disrupting cash flow.