Instant, flexible credit — right from your wallet.

Provide your customers with what they need most: instant access to cash when it matters. Ezra’s cash loan solution unlocks short-term credit — fast, frictionless and designed for real life fully embedded into the platforms people are already using.

Why Ezra

Approvals in seconds, disbursements in minutes

Ezra’s real-time credit engine enables loan approvals and wallet disbursements in minutes — no long forms, no delays — providing instant value to your customers.

Frictionless Access — Powered by Alternative Data

Ezra's credit scoring solution uses real-time wallet activity and usage patterns. No forms, no paperwork. Onboarding is instant, inclusive and built for customers overlooked by traditional systems.

Flexible repayments — Automatic wallet deductions

Repayments are designed around how customers live and earn, offering the flexibility to pay manually or through auto-deductions — reducing missed payments and improving user experience.

Drives customer retention

Real-time credit, paired with built-in affordability checks that ensure customers only borrow what they can manage. This protects against unnecessary churn, builds trust, and helps deliver a high-impact financial product that keeps users engaged over time.

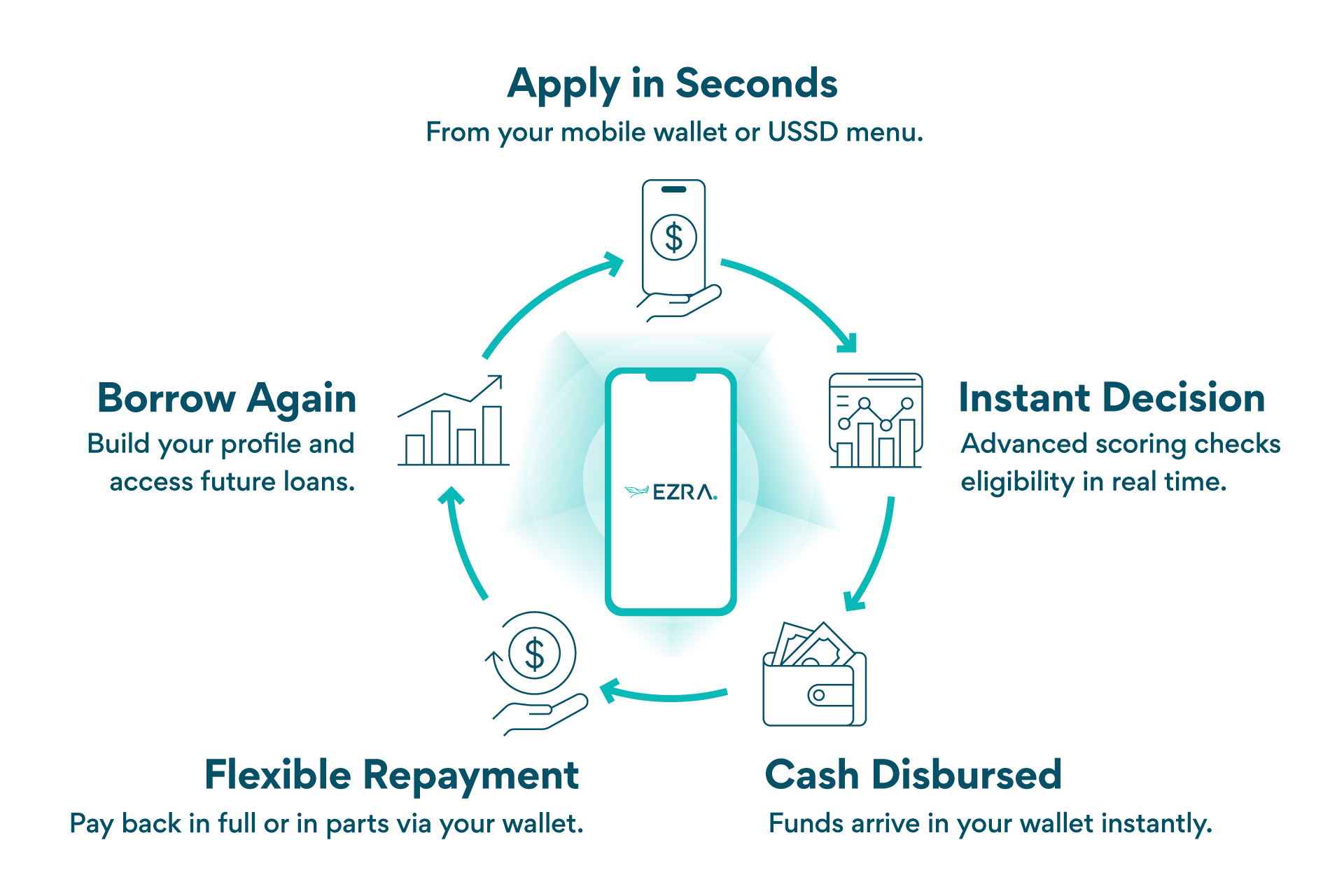

How it works

How it works

Customer applies via app or USSD

Ezra scores based on alternative data

Loan is instantly sent to wallet

Repayment happens manually or via auto-deduction on due date

Built for everyday life

School fees, hospital visits, sudden expenses — Ezra’s solutions give families instant support when they need it most. They empower women running small shops or home businesses with quick access to cashflow, helping them restock and stay open. For vendors, gig workers, and everyday earners, Ezra bridges shortfalls so they can keep working, earning, and showing up — without disruption.