Digital technology is powering a more interconnected world. However, lack of access to credit solutions remains a pressing issue for many, particularly those in financially underserved and excluded regions. But what can be done to address this imbalance? In this article, we explore how Ezra is empowering its partners to provide financial freedom to more people, in more places.

What is financial inclusion?

Financial inclusion is rooted in equal opportunity.

The World Bank defines financial inclusion asthe guarantee that individuals and businesses have access to useful and affordable financial products that meet their needs. And many around the world still lack adequate access to services such as credit and savings, making it difficult to participate in the wider economy.

Fortunately, as our world becomes increasingly digital, more innovative ways to include people in the financial ecosystem are changing the way we frame financial inclusion. And this is where technology-driven solutions – such as Ezra’s embedded credit solutions – can really make a difference.

Why does it matter?

Statistics suggest that even today, almost one in two people in Africa live in poverty, and only seven African countries have a monthly minimum wage equal to or more than $200. This makes essential items, such as mobile phones, incredibly difficult to purchase outright for many.

Without access to responsible credit facilities such as instant cash loans and device financing, those living in poorer communities often find it difficult to pull themselves out of the low income bracket or are forced to use unregulated predatory lending options. This in turn leads to greater levels of debt, more extreme levels of poverty and wider socio-economic imbalance.

Erwan Gelebart, CEO of Ezra, says: “Our world is becoming increasingly financially polarised. And, with the global cost of living crisis, societal divides between the richest and poorest are only set to widen. We have to take action, to stem the rise of growth inequality and ensure that anyone, anywhere, can access essential financial services. If not, those who are already financially underserved risk being further marginalised. This will perpetuate the cycle of inequality and poverty.”

Who does financial exclusion affect most?

Within any economic market, certain segments of society are hit harder by financial exclusion than others. For example, in emerging markets, women are less likely to successfully raise emergency money, and more likely to rely on unreliable sources for loans, such as friends and family.

Informal workers – such as street vendors, whose jobs very rarely include work-based social protection – in emerging economies also often find themselves in a precarious financial position. For example, informal workers account for 70% of the Southeast Asian workforce. And yet many find themselves financially underserved and excluded from the wider economy. This is due in part to cyclical debt which also makes it difficult to build a good credit history.

In emerging economies across Africa and Southeast Asia, limited access to credit services is also an issue that affects not only individuals, but also micro, small and medium-sized enterprises (MSMEs). More than 60% of MSMEs surveyed in Southeast Asia claimed that when they required financing, their loan applications had been unsuccessful. Without access to credit, it is incredibly difficult for MSMEs to scale.

How can technology make a difference?

In many emerging markets, the average age of the workforce is significantly younger than in more developed economies. Approximately half of Southeast Asia’s population is under the age of 30, and 65% of Africa’s population is under the age of 35. This means that the average populations within these markets are digital natives. Moreover, in Southeast Asia, while a significant number of people remain underbanked, 65% have access to the internet. This creates an opportunity to harness the power of digital connectivity to improve financial inclusion.

Digital payment forms are already on the rise in emerging markets. In Kenya, the widespread use of mobile money helped lift around 1 million people – 2% of the population – out of extreme poverty between 2008 and 2014. Ultimately, access to digital financial services allows more people in traditionally underserved markets to store and grow their savings, make investments, absorb unexpected financial hits and take out business loans, leading to new economic opportunities which have the potential to break the cycle of poverty.

How can technology make a difference?

From business loans to mobile device financing, Ezra’s simplified and streamlined access to credit solutions is helping to spark growth and economic opportunities in markets which have traditionally been financially underserved or excluded.

Today, 70% of mobile wallet providers are yet to launch a digital lending solution worldwide. Ezra partners with banks, mobile network operators, mobile money operators, utility companies and e-commerce platforms to deliver easy and rapid credit solutions in these markets. It provides this through one seamless platform integration which can be adapted to each business’ individual needs.

Ezra harnesses the power of each partner’s database to accurately score each end user. Our powerful credit scoring engine was built on sophisticated machine learning principles and has been refined over the last decade, to ensure our score cards keep getting smarter. Our partners now have the ability to provide their customers with a range of credit products that suit their needs and their wallets.

By investing in technology which grants consumers access to a wider range of financial services, players such as banks, mobile network operators, mobile money operators and utility providers can not only increase their product range, but also grow their customer bases. It has been shown that digital payments often act as a catalyst within communities to promote saving, borrowing and storing of money, thereby facilitating wider uptake and, therefore, further financial inclusion.

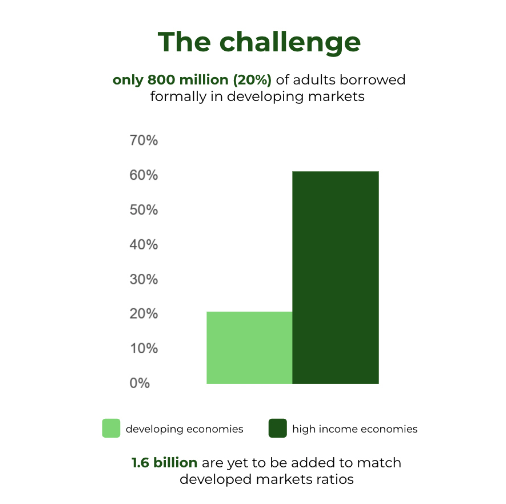

According to a 2018 report by McKinsey & Company, ‘digital finance has the potential to reach more than 1.6 billion new retail customers in emerging economies, and to increase the volume of loans extended to individuals and businesses by $1.2 trillion. Existing financial services providers also stand to reduce the direct costs of their current businesses by $400 million annually’. In this respect, financial inclusion not only delivers benefits for individuals and MSMEs, but also for financial services providers.

Gelebart says: “financial inclusion for all is the mission that drives us at Ezra. We are proud to have developed a product that promotes sustainable economic growth by delivering embedded lending solutions with accuracy, speed and efficacy. Our innovative credit scoring engine is bespoke, so our partners can be assured that their credit products will reach more people in more places than ever before.”

Ezra’s integration is not only easy to implement and rapid to deploy, but can also accurately profile millions of customers without a credit history more easily and effectively than ever before. We can therefore deliver instant loan decisions to millions of new, previously underserved customers, at little to no risk. Furthermore, Ezra’s fine-tuned credit scoring system allows us to ensure that at least 60% of our partners’ end consumers are eligible for a loan in a way that is responsible, risk-free for our partners and hassle-free for end consumers.

For more information on how we can help your business to promote financial inclusion, click here.

Sources:

- https://www.ftadviser.com/Partner-Contents114/2021/09/29/Hermes-Financial-inclusion-an-economic-opportunity-for-all

- https://www.finance-monthly.com/2022/06/the-importance-of-financial-inclusion-for-emerging-markets/

- https://www.fintechtris.com/blog/fintech-gains-momentum-africa

- Global Fintech Adoption Index, 2019

- The Global Findex Database, 2021

- https://www.bain.com/insights/fufilling-its-promise/

- https://www.smefinanceforum.org/data-sites/msme-finance-gap

- https://sustainabledevelopment.un.org/content/documents/2655SDG_Compendium_Digital_Financial_Inclusion_September_2018.pdf

- https://www.nationalgeographic.com/culture/article/paid-content-how-tech-is-empowering-southeast-asias-financially-underserved#:~:text=Did%20you%20know%20that%20over,%2C%20loans%2C%20or%20adequate%20insurance

- https://www.weforum.org/agenda/2022/02/closing-southeast-asia-s-financial-inclusion-gap/

- https://www.weforum.org/agenda/2022/08/how-consumer-credit-drives-growth-africa-e-commerce-sector/

- https://techforgoodinstitute.org/blog/reports/the-platform-economy-southeast-asias-digital-growth-catalyst/

- https://techforgoodinstitute.org/wp-content/uploads/2021/10/TFGI_Longreport_20211003.pdf

- https://www.worldbank.org/en/publication/globalfindex/Report

- https://www.worldbank.org/en/topic/financialinclusion/overview

- www.statista.com/statistics/915632/adults-with-bank-account-africa/

- https://www.smefinanceforum.org/data-sites/msme-finance-gap

- https://www.worldbank.org/en/topic/financialinclusion/overview

- https://www.worldbank.org/en/publication/globalfindex

- https://www.worldbank.org/en/news/feature/2022/01/11/developing-economies-face-risk-of-hard-landing-as-global-growth-slows