An Introduction To: Airtime Credit Services (ACS)

In our latest series, ‘An introduction to’, we’re lifting the lid on the products that are powering access to credit across emerging markets. Today, Airtime Credit Services (ACS). Help your customers to keep the conversation going – even with low to no balance. Airtime Credit Services (ACS) provides easy and convenient access to telecommunications services […]

An introduction to our product portfolio

Explore our full range of products, how they work, and which solution is the right one for you and your customers. Today, Ezra helps individuals and small-to-medium-sized enterprises (SMEs) in more than 24 countries access fast, simple, and responsible credit solutions. From cash to merchant loans, we are on a mission to design, develop, and […]

An Introduction to Cash Loans

In our latest series, ‘An introduction to’, we’re lifting the lid on the products that are powering access to credit across emerging markets. Today, cash loans. If you have yet to integrate lending products into your suite, cash loans are an ideal first step. But what do they do? How can they empower your customers, […]

Ezra: Innovative credit solutions for a more inclusive world

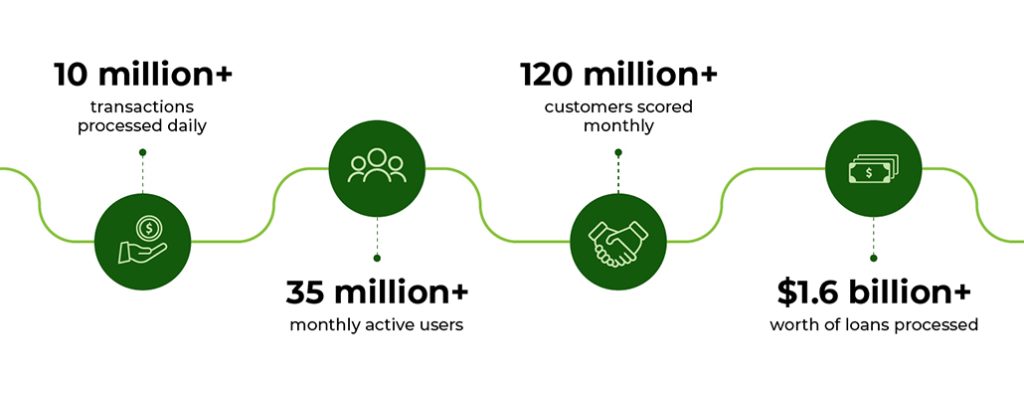

You may have come across Ezra before – and you may even have seen our products in action, without realising it. But what is Ezra? How do our products work? And why? Read on to find out more. 24 countries 10 million+ transactions processed daily 40 million+ monthly active users 120 million+ customers scored monthly $1.6 billion+ worth of […]

Financial Regulation in Africa: Challenges and Solutions

In any economy, a strong regulatory framework is essential for financial protection, inclusion, and growth. But across a continent as diverse and complex as Africa, where many individuals remain financially underserved and underbanked, what role does financial regulation play – especially when it comes to digital credit lending? And what can be done to improve […]

Ezra and Mobile Money Operators

Across the world, Mobile Money Operators and their customers are benefiting from Ezra’s easy, rapid, and robust lending solutions. Read on to learn more about what makes Ezra’s approach unique, and how our fully customisable products can help your brand to grow, and provide access to credit for more customers than ever before. What is […]

The importance of AI and machine learning in credit lending

From facial recognition to fraud detection, artificial intelligence (AI) is enabling service providers and institutions across the world to speed up complex processes, mitigate risk, and transform how we live, work, and manage our money. Like fintech itself, AI is the smart solution to the complex problems which affect end users across the world. AI […]

Ezra Team Profile: Peter Mugendi – Senior Software Engineer

At Ezra, our goal is to improve financial inclusion for all. Meet the people behind our brand, who are making this possible. Peter Mugendi is our Senior Software Engineer. He talks teamwork, key learnings, and work with a positive global impact. What does your role involve? I’m a Senior Software Engineer with User Interface (UI) […]

Alternative data: a new era for credit lending

Alternative data has the potential to propel global financial inclusion even further forward. But what is it? How does it work? And what does it mean for the future of credit access in emerging and developing markets? Alternative vs. traditional data Alternative data is changing the face of lending across the world. It is opening […]

Leveling up the global economy: Why credit lending matters for financial inclusion

We all require access to affordable, useful financial products and services. This, in essence, is the core purpose of financial inclusion – to ensure that access to financial services is not a barrier to economic development. However, despite services such as mobile money driving an increase in global account ownership, millions of people still lack access to essential financial […]